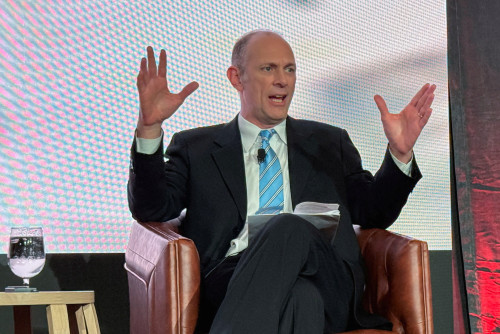

(Reuters) -Chicago Federal Reserve Bank President Austan Goolsbee said on Monday he continues to think the U.S. central bank will be able to lower short-term borrowing costs after the “dirt in the air” of uncertainty from tariff policies gets cleared up.

“If we can get past this bumpy period, the dual mandate looks pretty good,” Goolsbee said in a webcast interview with the Quad Cities Regional Business Journal in Davenport, Iowa. The Fed’s dual mandate refers to its two goals: full employment and price stability. Goolsbee said he continues to believe that if the economy remains in that state and tariffs don’t turn out to be as aggressive as announced on April 2, the Fed’s policy rate will probably be a “fair bit” lower within the next 15 months.

So far, he said, the labor market looks strong, and recent inflation readings, with the personal consumption expenditure price index rising just 2.1% in April from a year earlier, have been pretty good.

But the inflation figures so far probably don’t incorporate much impact from the tariffs, Goolsbee added.

“Personally, I’m a little gun-shy,” he said, about assuming that the impact of those levies will be temporary, given that in the post-pandemic period the Fed turned out to be wrong in forecasting inflation at that time would be short-lived. Instead it soared to 40-year highs, forcing the Fed to raise its policy rate aggressively in response.

(Reporting by Ann Saphir; Editing by Leslie Adler and Andrea Ricci)