By David Jeans

NEW YORK, Dec 18 (Reuters) – A New York investment manager has been indicted for allegedly defrauding millions of dollars from investors in a sham pre-IPO scheme tied to U.S. drone-maker Anduril Industries, highlighting the risk of fraud as private tech firms grow more prominent and valuable.

Giovanni Pennetta, manager of Sestante Capital, was arrested on Sunday at JFK International Airport and later charged with securities fraud, wire fraud and aggravated identity theft, the Department of Justice said. Prosecutors say he falsely promised clients “economic exposure” to non‑public shares in Anduril, raising millions of dollars despite having no access to the company’s stock.

An attorney for Pennetta declined to comment.

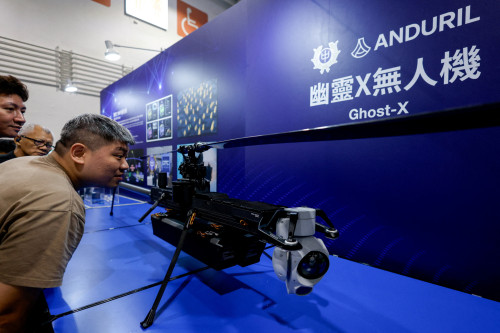

Anduril, which makes drones and military AI software for the Pentagon, and was valued at $30 billion in a funding round in June, declined to comment on the case. Spokesperson Jackson Lingane directed Reuters to a memo on the company’s website that stated: “Any offer to invest in Anduril that does not come from or through Anduril is very likely a scam.”

In an exchange on X this week, Anduril founder Palmer Luckey accused crypto firm AlphaTON of defrauding investors after the firm announced it had made a $30 million investment in Anduril. Soon after, AlphaTON said in a press release it had cancelled the investment.

AlphaTON and its CEO Brittany Kaiser didn’t respond to a comment request.

The Pennetta case and the AlphaTON claims underscore the growing risk of scams targeting investors as private tech firms like OpenAI, SpaceX and Anduril gain prominence but restrict public share distribution.

Victims are often approached with glossy presentations, fake documents and promises of exclusive access to private companies.

In September 2024, the Securities and Exchange Commission charged three people involved in an alleged scheme to fraudulently offer pre-IPO shares in private companies, generating $120 million from hundreds of investors. In a separate case, three sales executives were arrested in February on charges brought by the Eastern District of New York relating to an alleged pre-IPO fraud scheme.

Companies like Anduril and SpaceX are staying private for longer than typical companies, said Daniel Taylor, director of the Wharton Forensic Analytics Lab at the University of Pennsylvania.

“There’s less ability for public scrutiny, corporate transparency, and public surveillance, and that makes fraud and manipulation more rampant in the private space,” Taylor said.

(Reporting by David Jeans and Joe Brock; Editing by Daniel Wallis)